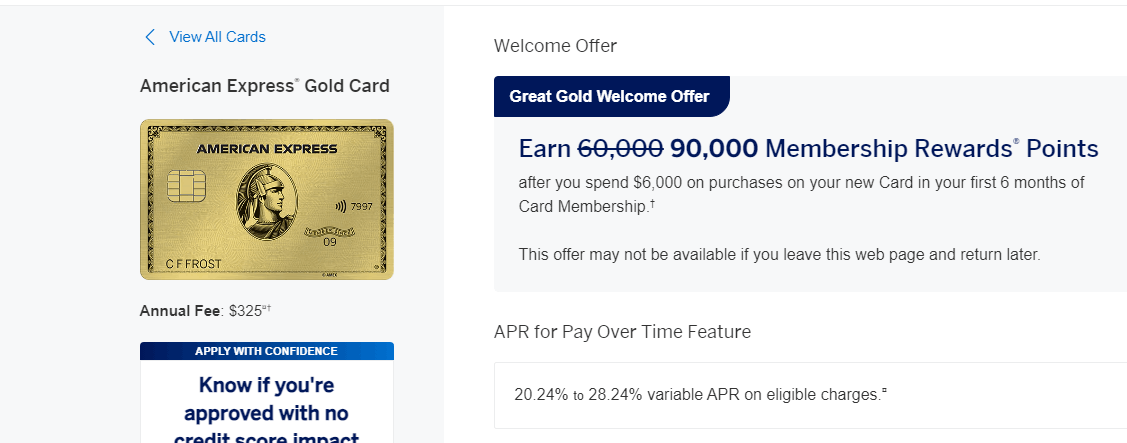

The American Express Gold Card offers a 60,000 membership rewards points welcome bonus.

With Amex Gold 60K points, you can unlock significant travel perks, cashback options, and more.

If you frequently spend on dining and groceries, this card is a valuable addition to your wallet.

Overview of the American Express Gold Card

This card has a $325 annual fee and an APR of 20.99% to 28.99%. This is offset by the dining and Uber credits for frequent users.

Cardholders also receive $120 in dining credits and $120 Uber Cash annually, helping offset the annual fee.

The Amex Gold 60,000 points promotion comes with several benefits.

- 4X points on dining (including takeout and delivery)

- 4X points at U.S. supermarkets (up to $25,000 per year)

- 3X points on flights booked directly with airlines or Amex Travel

- 1X points on all other purchases

Additional Benefits of the Card

The American Express Gold Card 60000 points offer is just one part of the value this card provides. Cardholders also benefit from:

- No foreign transaction fees, making it ideal for international travel

- Purchase protection, covering eligible items against theft or damage

- Extended warranty, adding additional coverage to manufacturer warranties

- Amex Offers, providing targeted discounts and cashback deals

- Hotel Collection Perks. Up to $100 hotel experience credit when booking through The Hotel Collection with Amex Travel (requires a minimum two-night stay).

- Secondary rental car coverage.

These benefits add financial security and enhance the card’s value beyond the initial Amex Gold 60,000 points bonus.

How to Earn the 60,000 Sign-Up Points

To qualify for the Amex Gold 60000 points bonus, new cardholders must spend $6,000 within the first six months of opening the account.

Eligible purchases include everyday expenses like groceries, restaurants, and bills.

However, cash advances, gift card purchases, and balance transfers do not count toward the spending requirement.

If you plan your purchases strategically, meeting the Amex Gold 60K threshold is achievable without overspending.

Best Ways to Redeem the Points

The 60,000 membership rewards points Amex can be redeemed in various ways.

The best redemption value typically comes from travel rewards.

- Travel Transfers: Convert points to airline partners like Delta, British Airways, and Emirates.

- Amex Travel Portal: Book flights, hotels, and rental cars using points.

- Statement Credits & Cashback: Offset previous purchases.

- Gift Cards & Shopping: Redeem for gift cards or purchases at select retailers.

Transferring points to airline and hotel partners often yields a higher value than redeeming for cash or statement credits.

Who Should Apply?

The Amex Gold Card is ideal for individuals who spend heavily on dining, groceries, and travel.

Those with a stable income and responsible money management can benefit significantly.

If you frequently use credit cards for everyday expenses, you can easily reach the Amex Gold 60K spending requirement.

However, if you don’t spend enough to justify the $325 annual fee, other cashback or no-annual-fee cards may be better suited for your needs.

How to Apply

Applying for the Amex Gold 60,000 points offer is simple. Follow these steps:

- Visit the official American Express website.

- Click on the Apply Now button.

- Fill out your personal and financial details. This includes name, address, phone, email, SSN and income details.

- Review the terms and conditions.

- Submit your application and wait for approval.

A good to excellent credit score (typically 700+) increases your chances of approval. Once approved, you’ll receive your card in 7-10 business days.

Amex Gold vs. Other American Express Cards

American Express offers a diverse range of credit cards, whether you’re looking for

- Luxury travel perks (Platinum)

- Dining rewards (Gold)

- Cashback on groceries (Blue Cash Preferred)

- Business benefits (Business Platinum)

Here’s a comparison table between the Amex Gold Card and some of the most popular Amex cards across different categories.

| Feature | Amex Gold Card | Amex Platinum | Amex Green | Blue Cash Preferred | Amex Business Gold |

| Annual Fee | $325 | $695 | $150 | $95 (waived 1st year) | $375 |

| Best For | Dining & Groceries | Luxury Travel & Lounge Access | General Travel | Cashback on Supermarkets & Gas | High Business Spending |

| Rewards Structure | 4X Dining, 4X Groceries, 3X Flights | 5X Flights, 5X Hotels | 3X Travel, 3X Dining | 6% Supermarkets, 6% Streaming, 3% Gas | 4X in Top 2 Business Categories |

| Welcome Bonus | 60K–75K Points (varies) | 80K–150K Points (varies) | 40K–60K Points | $250–$350 Cashback | 70K–100K Points (varies) |

| Dining Benefits | $120 Dining Credit | No specific dining perks | No dining credit | No dining perks | No dining perks |

| Travel Perks | No Lounge Access, Hotel Collection | Centurion Lounge, Priority Pass, Fine Hotels & Resorts | $189 CLEAR Credit, LoungeBuddy | No Travel Perks | No Lounge Access, Business Perks |

| Flight Benefits | 3X Points on Flights | 5X Points on Flights, $200 Airline Credit | 3X Points on Flights | No Flight Benefits | 3X Points on Flights |

| Uber Credit | $120 Uber Cash | $200 Uber Cash | No Uber benefits | No Uber benefits | No Uber benefits |

| Hotel Benefits | The Hotel Collection | Fine Hotels + Resorts | No special hotel perks | No hotel perks | The Hotel Collection |

| Foreign Transaction Fees | None | None | None | 2.7% Fee | None |

| Cashback Option? | No | No | No | Yes (Cashback) | No |

| Best Alternative To | Everyday spending on dining & groceries | Travelers who want lounges & luxury perks | Budget travelers who want solid rewards | Shoppers focused on supermarkets & streaming | Business owners who want flexible rewards |

Bank Info & Contact

For inquiries related to the Amex Gold 60,000 points promotion or other card details, contact American Express customer support.

- Customer Support: Call the official Amex helpline at 800-528-4800.

- Online Assistance: Visit the Amex website or use the live chat feature.

- Address: New York, 200 Vesey St, United States.

- Social Media Support: Reach out via Twitter, Facebook, or Instagram.

- Security Reminder: Always verify contact details through the official Amex website to avoid fraud.

Final Thoughts

The American Express Gold Card 60,000 points sign-up bonus is a great way to maximize rewards.

If you meet the spending requirement and use the bonus wisely, this offer provides excellent financial value.

To apply for the Amex Gold 60,000 points offer, visit the American Express website today and start earning rewards on your purchases.

Note: There are risks involved when applying for and using credit. Consult the bank’s terms and conditions page for more information.